The import-export situation of footwear products in China is quite balanced, with a focus on rubber and plastic footwear.

Key statistics of this article: China’s export structure data of footwear products, China’s import structure data of footwear products, etc.

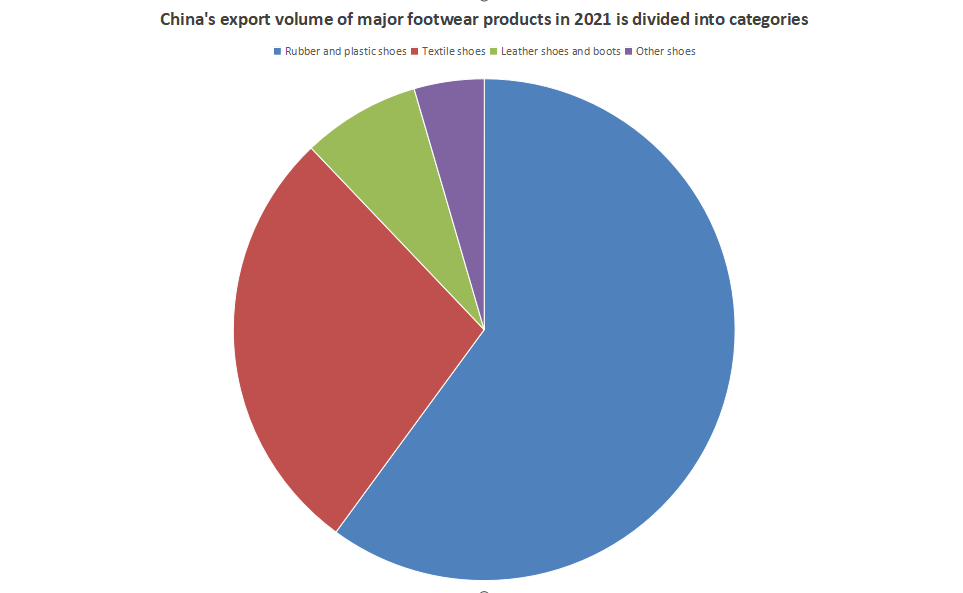

In terms of the export volume structure, rubber and plastic footwear products currently dominate the footwear market as the main category of exports. According to customs statistics, in 2020, China’s rubber and plastic footwear products exported a remarkable 4.44 billion pairs, accounting for a significant share of the total footwear exports. The export volume of textile footwear products was 2.059 billion pairs, accounting for 27.8% of the total export volume, while the combined export volume of these two product categories accounted for 87.8% of the total export volume.

Furthermore, customs statistics revealed that the total export volume of rubber and plastic footwear products reached US$17.101 billion, accounting for a substantial 48.3% of the total exports; the total export volume of textile footwear products reached US$9.988 billion, accounting for 28.2% of the total exports.

The imported footwear products display a more balanced trend.

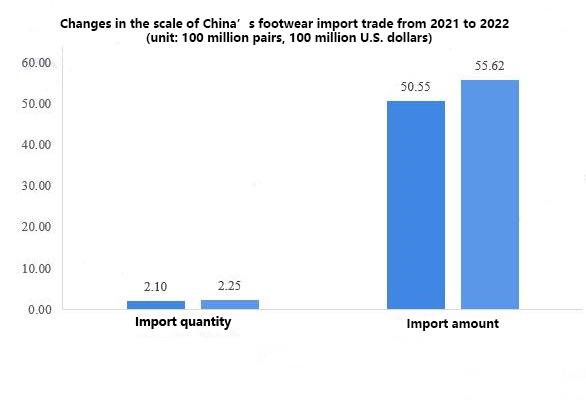

In terms of imports, although the scale of China’s footwear imports is significantly smaller than that of exports, the import trend in 2021 is a complete opposite of that of exports. The import scale of footwear products has defied the general trend. In 2021, the country’s footwear product imports are projected to reach 225 million pairs, an impressive year-on-year increase of 7.1%. Additionally, the import volume is projected to be US$5.562 billion, representing a year-on-year increase of 10.0%.

From an import volume perspective, textiles currently dominate the imported footwear products in the footwear market. According to customs statistics, in 2021, China’s import volume of textile footwear products reached an impressive 98.078 million pairs, accounting for a significant 10% of the total footwear imports. In addition, the import volume of rubber and plastic footwear products was 53.382 million pairs, accounting for 23.7% of the total footwear imports. The import volume of leather footwear products was 72.897 million pairs, accounting for 32.3% of the total footwear imports.

Moreover, the customs statistics further revealed that the total import volume of textile footwear products amounted to US$2.214 billion, accounting for a substantial 39.8% of the total import volume; the total import volume of leather footwear products reached US$2.401 billion, accounting for a remarkable 43.2% of the total import volume. Lastly, the total import volume of rubber boots was US$856 million, representing a notable 15.4% of the total import.

China’s footwear exports have grown significantly in recent years. One of the primary factors contributing to this growth is the significant improvement in production technology and efficiency. Chinese footwear manufacturers have made significant investments in new machinery and equipment, which has allowed them to increase their production capacity and ensure consistent quality. Additionally, the government has implemented policies to support the development of the footwear industry, including providing financial incentives, providing access to high-quality raw materials, and implementing stricter regulations to ensure product compliance. These efforts have encouraged footwear manufacturers to expand their operations and increase their exports. In addition, the rise of online shopping has also contributed to the growth of China’s footwear exports, as consumers in China are increasingly turning to online platforms for their footwear purchases. The convenience and wide selection of footwear available online have made it easier for Chinese consumers to access and purchase footwear from international brands, further driving the growth of China’s footwear exports.

In China, MYWAY footwear factory faces several key challenges and opportunities. One of the biggest challenges lies in the intense competition from international brands. These brands have established strong footholds in the market, which makes it difficult for domestic manufacturers to compete effectively.

Furthermore, the environmental regulations in China are another challenge for the MYWAY footwear factory. The country is committed to reducing pollution and protecting the environment. This means that manufacturers must comply with strict standards and regulations, which can be costly and time-consuming.

However, China also offers numerous opportunities for the MYWAY footwear factory. The country’s massive population and rising disposable income mean there is a growing demand for footwear. Shoes Manufacturers can capitalize on this by offering innovative and high-quality products that cater to the evolving needs of consumers.

Moreover, the Chinese government is actively supporting the development of domestic brands. They have launched initiatives to promote local brands and reduce reliance on foreign brands. This provides an opportunity for domestic manufacturers to gain recognition and establish a loyal customer base.

To overcome the challenges and seize the opportunities, footwear manufacturers in China need to adopt innovative approaches. We can invest in research and development to create new and improved products, as well as explore new markets and explore alternative sources of supply.